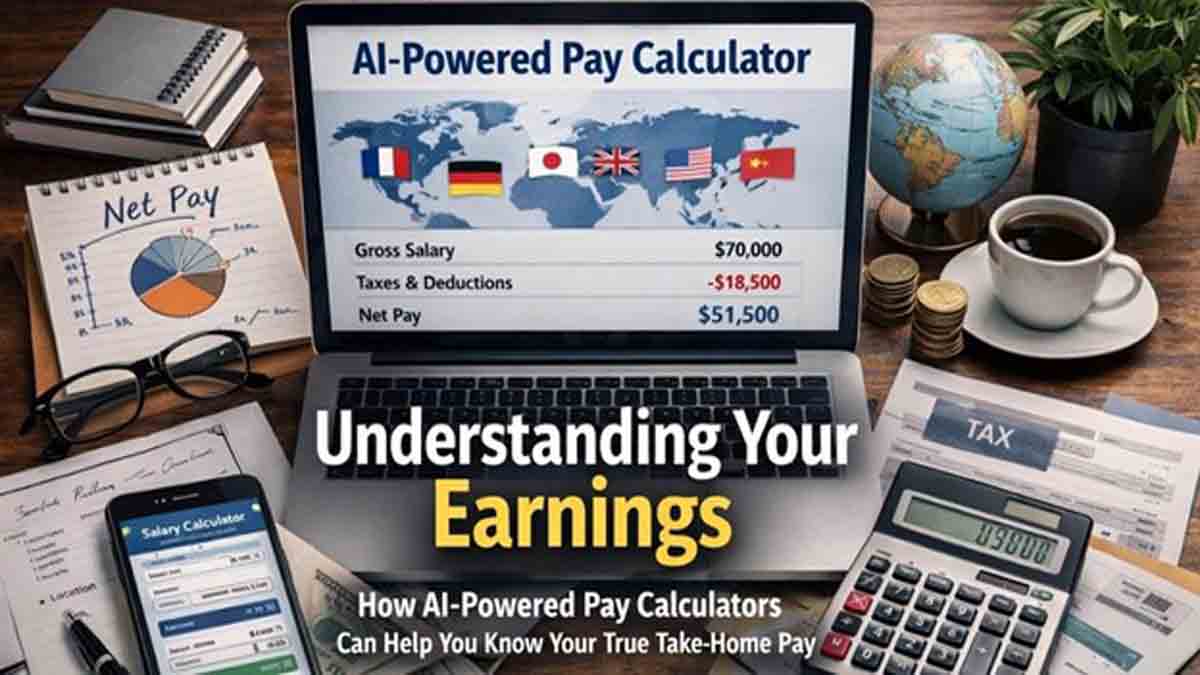

Knowing the amount of money you will really bring home after taxes has become a crucial issue in the contemporary job market all over the world. The amount of gross salary is not a true picture of the financial situation because taxation systems, deductions and contributions vary broadly across states. The intelligent tools have become valuable to professionals, freelancers, and job seekers in an effort to enjoy clarity of their real earning potential. Platforms such as the India Pay Calculator 2026 help users estimate net income accurately by combining personal inputs with real-time market data, making financial planning far more transparent and reliable.

Table of Contents

ToggleWhy Net Salary Matters More Than Gross Income

Gross salary figures are usually very attractive, and they seldom capture the entire picture. The balance of tax, social security contributions and compulsory deductions may greatly decrease the take-home pay. In other countries, these deductions depend on the geographical location, income level and the kind of employment. In the absence of proper calculation, people can overestimate their disposable income, and this will result in budgeting problems and unrealistic expectations. Knowledge of net salary enables individuals to make astute judgements on employment opportunities, living standards and long-term financial obligations.

The Growing Need for Accurate Salary Estimation Tools

Due to the globalization of work, the comparison of salaries on a cross-border basis is becoming increasingly popular. It is important that professionals, in the situation when they are thinking about relocation or work-off opportunities, are aware of the impact of local taxation systems on their earnings. Handwritten calculations or standard online tables do not usually reflect the existing laws. That is where AI-driven salary estimation software will be important because it can give the user accurate and location-focused data, which will enable them to evaluate the opportunities and make choices.

How AI Improves Salary Calculations

AI can improve the calculation of salaries, as complicated data is calculated effectively. With the help of user inputs and real-time market data, AI-based tools provide personalized estimates that are more precise than traditional calculators. This is a strategy to make deductions, taxes, and contributions with the latest rules to minimize the potential risks of mistakes. What is produced is a transparent and realistic image of what users can expect to bring home every month or year.

Understanding the Calculation Process

The first type of an intuitive pay calculator would usually start with questions like income level, job position and location. The system then implements the present rates of tax, deductions and contribution amounts that are required in that region. The site does not provide a perplexing set of formulas but provides a straightforward breakdown of gross income and net pay. Such openness makes users know precisely what happens to their money and how various influences affect their eventual earnings.

Country-Specific Salary Insights

A modern salary calculator allows for country-specific results, which is one of the main benefits of this tool. Specialized France, Germany, Japan, the United Kingdom, the United States, and China enables its users to discover the impact of the tax regime in each country on take-home pay. This is particularly useful to international professionals and businesses that have various markets to operate in because comparisons of salaries across different borders is no longer uncertain.

A Closer Look at Salary Calculations in Japan

In Japan, the compensation system incorporates various elements that are taxation on the national income, tax on the local resident, and mandatory social contribution that may be confusing to those people who are new to the job and taxation rules in Japan. In the absence of the relevant tools, take-home pay is hard to estimate and erroneous. To simplify this process, a special Japan pay calculator can be used, taking into account these required deductions and a clear estimate of net salary can be provided. This transparency is especially beneficial to the expatriates and other foreign professionals requiring dependable information in case they want to take a job proposal, estimate the living costs, or make a prudent choice concerning the relocation and financial sustainability in the long run.

Supporting Better Career Decisions

Precise salary information is essential in career planning. It does not matter whether it is the negotiation of a raise, a change of industries, or moving abroad; people can use the net income to figure out the actual worth of the opportunity. A trustworthy pay calculator will help people to look realistically and compare the offers so that the career move is appropriate to the career objectives and economic meaning.

Benefits for Freelancers and Independent Professionals

The income estimation is more complicated because freelancers and contractors usually experience high and low income and tax payments. An AI-based salary estimation that could be used by these professionals assists them in modelling various earning situations and knowing the impact of deductions on net income. This helps in improved pricing policies, tax arrangements and general financial stability year-round.

The Importance of Real-Time Market Data

Tax laws and other economic factors are dynamic, and even minor changes can have long-lasting impacts on the amount of take-home pay. The use of obsolete data will only create wrong estimates of salaries, which may cause bad budgeting and unrealistic financial assumptions. With real-time market data on board, an AI-based platform can make sure that the amount of salary is based on the existing tax regulations, contribution rates and economic trends. This is particularly relevant among those with time-sensitive decisions to make, like accepting a job opportunity, negotiating salary or planning to relocate. Recent information would enable people to have confidence in the findings and make sound decisions on the financial reality of today, and not be based on previous assumptions.

Making Complex Tax Systems Easy to Understand

The laws of taxation are generally complicated and cannot be understood without professional assistance, especially for people who operate in various regions or countries. These systems made easier through an intuitive salary calculator that breaks down complex tax regulations in to easy to understand formats. The user does not require any high level of financial or accounting expertise to view how income taxes, deductions and mandatory contributions affect their net salary. The platform simplifies the presentation of information, hence eliminating the possibility of confusion and minimizing reliance on manual calculations. This availability lets the users gain greater insight into their financial status and have more command over their incomes with more confidence.

Planning with Confidence and Clarity

Being aware of your real take-home pay leaves no guessing in financial planning and allows you to make better long-term decisions. Whether a person is preparing a monthly budget, estimating a new employment opportunity or is planning the relocation to another country, proper estimates of salary will give them a good basis. There are also such tools as the India Pay Calculator 2026 that give the user a clear understanding of the impact that taxes, deductions, and contributions have on their income. Such transparency enables people to be more realistic in terms of expense planning, savings and lifestyle decisions. Having a reliable perspective of net income, users can proceed with their plans without any hesitation because they are confident that all their financial plans found on quality and transparent information.

A Smarter Approach to Understanding Earnings

In the global world where financial transparency is becoming a vital issue, AI-enabled pay calculators are a convenient and valid option in gaining insights into actual income. Integrating user inputs and current market data and country-specific tax regulations, these sites help provide personalised salary information without emptiness and exaggeration. Users will have a better understanding of the amount of money they can make as opposed to basing it on assumptions or some general averages. This more intelligent strategy promotes wise career and financial choices, particularly in an international employment environment where tax systems differ greatly. Finally, these tools enable an individual to make accurate, transparent, and confident choices.

Also Read: 5 Essential Power Engineering Skills Every Electrical Engineer Should Master in 2026

How AI-Powered Pay Calculators Help You Understand Your Real Earnings

Shashi Teja

Related posts

Hot Topics

How AI-Powered Pay Calculators Help You Understand Your Real Earnings

Knowing the amount of money you will really bring home after taxes has become a crucial issue in the contemporary…

Boost Your SIP Returns: 5 SIP Mistakes You Can Easily Avoid

A Systematic Investment Plan (SIP) has become one of the most popular ways to invest in Mutual Funds. It helps…