The NFTs or Non-Fungible Token are fast becoming a haven for artists looking to carve a niche by selling directly to willing buyers in the digital assets market. However, pricing NFTs is quite challenging since the market is still new in the cryptocurrency ecosystem and the high-volume production rate coming from the developer’s workshop.

So far, no blueprint outlines a methodology of NFTs pricing except copying tangible art valuation processes. There’s a massive gap between digital assets and price management that can affect the liquidity of NFTs in the cryptocurrency landscape.

In addition, the types of NFTs and their functions, such as an NFT game guide, can influence how users relate to the tokens and the value of each token produced. Also, the most relevant market and the auction sale of digital tokens significantly impact the exchange prices in the digital space.

Here are some of the considerations when pricing NFTs.

Table of Contents

Toggle1. Security For NFTs And the Chain

An NFT exists in a blockchain and may rely on security features to protect the production and transaction of the underlying digital asset. So, creators must be in established blockchains such as Ethereum to create and source buyers for their NFTs.

In addition, NFT creators can leverage smart contracts to price their creations and enjoy a secure channel for releasing the masterpieces. On the other hand, the underlying blockchain performance in the cryptocurrency landscape can also contribute to NFTs pricing.

2. NFT Metadata

Metadata can significantly influence the prices of NFTs produced in the intrinsic market. Blockchains that host NFTs can give creators options such as on-chain and off-chain metadata to determine the best route to incorporate in their NFT production.

On-chain allows creators to include metadata in the smart contracts to represent the token. Such provisions make NFTs valuable since they should meet the underlying blockchain standards and become tradeable through liquidity premium. In addition, on-chain metadata guarantees the NFTs’ existence into the unforeseen future or blockchain’s lifetime.

Off-chain complicates incorporating metadata and has limitations such as storage implemented by blockchains like Ethereum. The NFTs host is a crucial consideration of the prices and on-chain or off-chain metadata addition.

3. Rarity Of NFTs

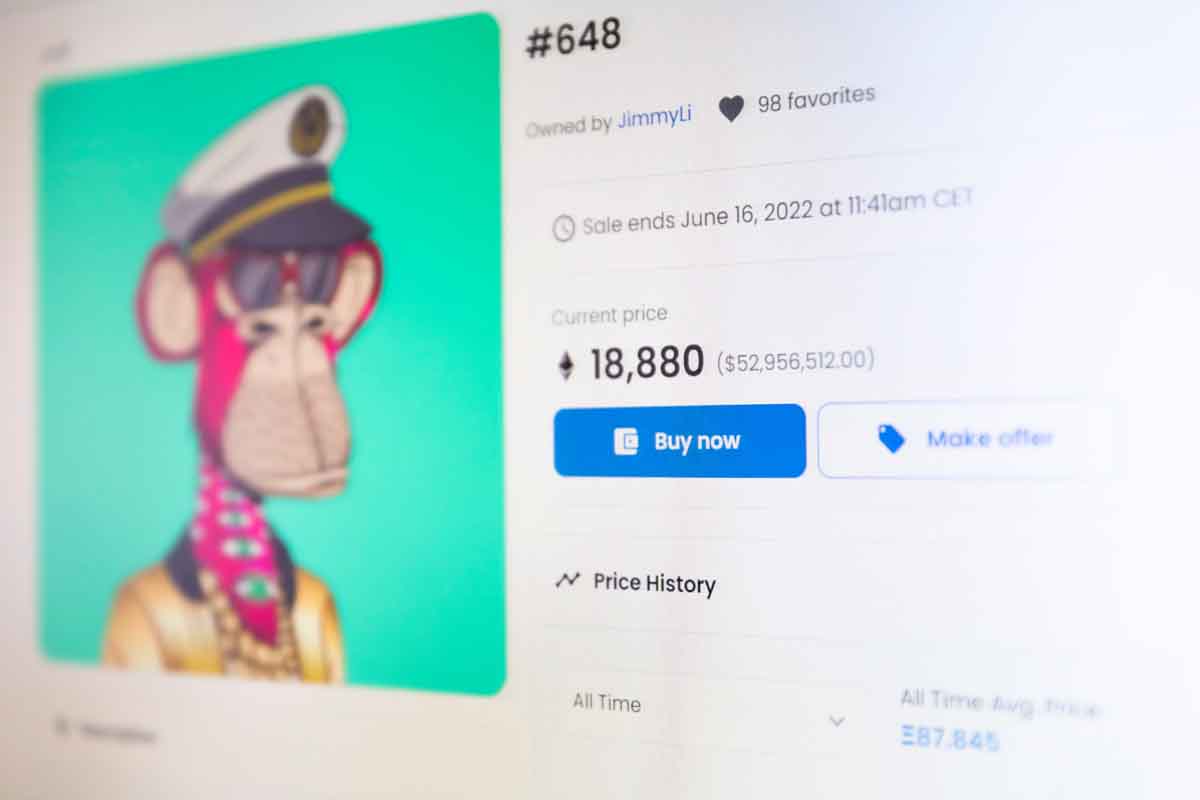

Pricing NFTs rides on the unique element attached to the tokens minted in the cryptocurrency field compared with classic or rare artifacts. Such characteristics of NFTs tilt the supply and demand balance, thereby making NFTs a highly prized possession.

The gaming and art industries are areas where NFTs have become crucial components. Artists are constantly producing unique masterpieces with the NFT art guide to help users enjoy transacting the tokens.

In addition, NFTs platforms are breaking down tokens into several tiers to signify the rarity of the digital assets. The top-level NFTs attract higher value in the venue or exchange.

4. Age

Age is a factor in the NFT market and may affect the prices of tokens minted in the cryptocurrency ecosystem. NFTs released in 2018 have better pricing when compared to the ones launched in 2021. However, the NFT market keeps getting new debutants since it’s still in the development stage, and pricing methodology is non-existent.

5. The Creators And Crypto Community

NFT marketability and recognition are crucial for a token to penetrate the crypto community and can be a price-determining point. The content created should be relevant to the users in the digital assets’ scape to ease the transaction of the underlying tokens.

Moreover, NFTs that support an influencer or celebrity will sell quickly in the speculative market. For that reason, creators are moving to include artists in a bid to produce top-notch content for tokens and hopefully promote sales. And it’s probably the reason people are buying into the idea of NFTs, as seen in the gaming industry.

6. Number Of NFTs In Circulation

The pricing of NFTs depends on the number of tokens minted by creators. And if the tokens flood the market, expect the prices to be low since the digital assets are readily available.

Minters with limited production can tilt the price scale by charging more in the speculative market. Such practices attract investors because of the unique nature of NFTs coupled with the scarcity of digital assets.

7. Tangibility

NFTs depict natural objects wrapped in blockchains that protect ownership of the underlying token from manipulation or fraud. Such features give NFTs tangible value to enable trading of the digital assets in different real-life scenarios.

You can invest in real estate using NFTs or tickets that have a short expiry attached to them. The pricing of the NFT can refer to the actual cost of the natural objects it represents by looking at the liquidity spectrum.

8. Richness

The NFTs’ content significantly impacts the pricing because of the additional components and extra features attached to the tokens. Such incentives enhance user experience and may be exclusive to the NFTs owners.

A simple audio recording of a celebrity can spike the prices of NFTs, and it becomes profitable to the creators. Instances of NFTs richness are seasonal access to exclusive suites during basketball games and interacting with game legends.

9. Liquidity Premium

Liquidity in the NFTs trading floor makes the tokens attractive to investors because they can leverage the high trading volume. Trading orders fill fast, and traders can collect profits once they realize gains.

Interestingly, NFTs retain their value even when the supporting blockchain goes under or loses value. On the other hand, If an NFT is dormant in the market, a depreciating system will create a competitive front that can influence the pricing of debutant NFTs.

10. Market Speculation And Volatility

The ideology of NFTs doesn’t relate well with speculation, but the market inclines toward that direction. The market forces unpredictability of the NFTs’ price actions and can spark from a simple premise and send shockwaves to the top price.

The market volatility causes price swings and can significantly affect the pricing of NFTs. Traders, creators, and investors can watch speculation triggers to leverage the NFT markets.

Strong Tailwinds

In NFTs, the pricing of the underlying tokens is a mystery simply because of the decentralized nature of digital assets. The more tokens debut in the market, the more challenging it is to determine a probable pricing system. However, the NFTs valuation mirrors most traditional art pricing systems since it’s a new channel for artists to produce or mint and sell directly to willing buyers in the digital space.

Shashi Teja

Related posts

Hot Topics

What is Kafka Used For: A Complete Guide

What is Kafka used for? If you’ve been diving into the world of distributed systems, microservices, or data streaming, you’ve…

How Do Password Managers Work? The Guide That Finally Makes Sense

Ever wonder how do password managers work and whether they’re actually safe? I get it. The idea of putting all…