Choosing the right accounting tool for your business can be a daunting task, especially with so many options available. In this blog, we will compare three popular accounting tools: Zoho Books, Xero, and ZarMoney. Each of these platforms offers unique features and benefits that can cater to different business needs. By the end of this comparison, you will have a clearer understanding of which accounting software might be the best fit for your business.

Table of Contents

Toggle1. ZarMoney

ZarMoney is a comprehensive accounting solution designed to meet the needs of businesses of all sizes. Whether a small business owner or managing a large enterprise, ZarMoney offers a range of features that simplify your accounting processes. Known for its user-friendly interface and robust functionality, ZarMoney is a strong contender in the accounting software market.

Features of ZarMoney

- User-Friendly Interface

- Customizable Invoices

- Inventory Management

- Bank Reconciliation

- Expense Tracking

- Multi-Currency Support

- Financial Reporting

- Accounts Payable and Receivable

- Sales Tax Management

- Customer and Vendor Management

Top 3 Features with Explanations

1. Customizable Invoices:

ZarMoney, a Zoho Books alternative, allows you to create invoices that reflect your brand’s identity. You can add your logo, choose colors, and include personalized messages, making your invoices stand out.

2. Inventory Management:

With real-time inventory updates, you can avoid stockouts and overstocking. ZarMoney helps you keep track of your inventory levels, making inventory management more efficient.

3. Multi-Currency Support:

ZarMoney’s multi-currency feature enables you to handle international transactions seamlessly. You can invoice customers in their local currency and manage exchange rate fluctuations.

Pros of ZarMoney

- Easy to use, even for those with limited accounting knowledge.

- Offers a wide range of features that cater to various business needs.

- Suitable for businesses of all sizes, from small startups to large enterprises.

Responsive and helpful customer support team. - Highly customizable to fit the specific needs of your business.

Cons of ZarMoney

- Some users might experience a learning curve when first using the software.

Pricing

ZarMoney offers a straightforward pricing structure. The plans are as follows:

- Starter Plan: $15 per month for one user.

- Business Plan: $20 per month for two users.

- Enterprise Plan: Custom pricing for larger teams and enterprises.

All plans come with a free trial period, allowing you to test the features before committing.

Final Verdict

ZarMoney stands out as a powerful accounting tool that offers extensive features and a user-friendly experience. Its ability to scale with your business makes it a versatile choice for both small businesses and larger enterprises. While it may come with a higher price tag compared to some competitors, the range of features and excellent customer support justify the investment. If you’re looking for an accounting solution that can grow with your business and handle complex accounting needs, ZarMoney is worth considering.

By comparing Zoho Books, Xero, and ZarMoney, you can make a more informed decision about which accounting tool will best meet your business’s needs. Each software has its strengths, and your choice will depend on the specific requirements and budget of your business.

2. Zoho Books

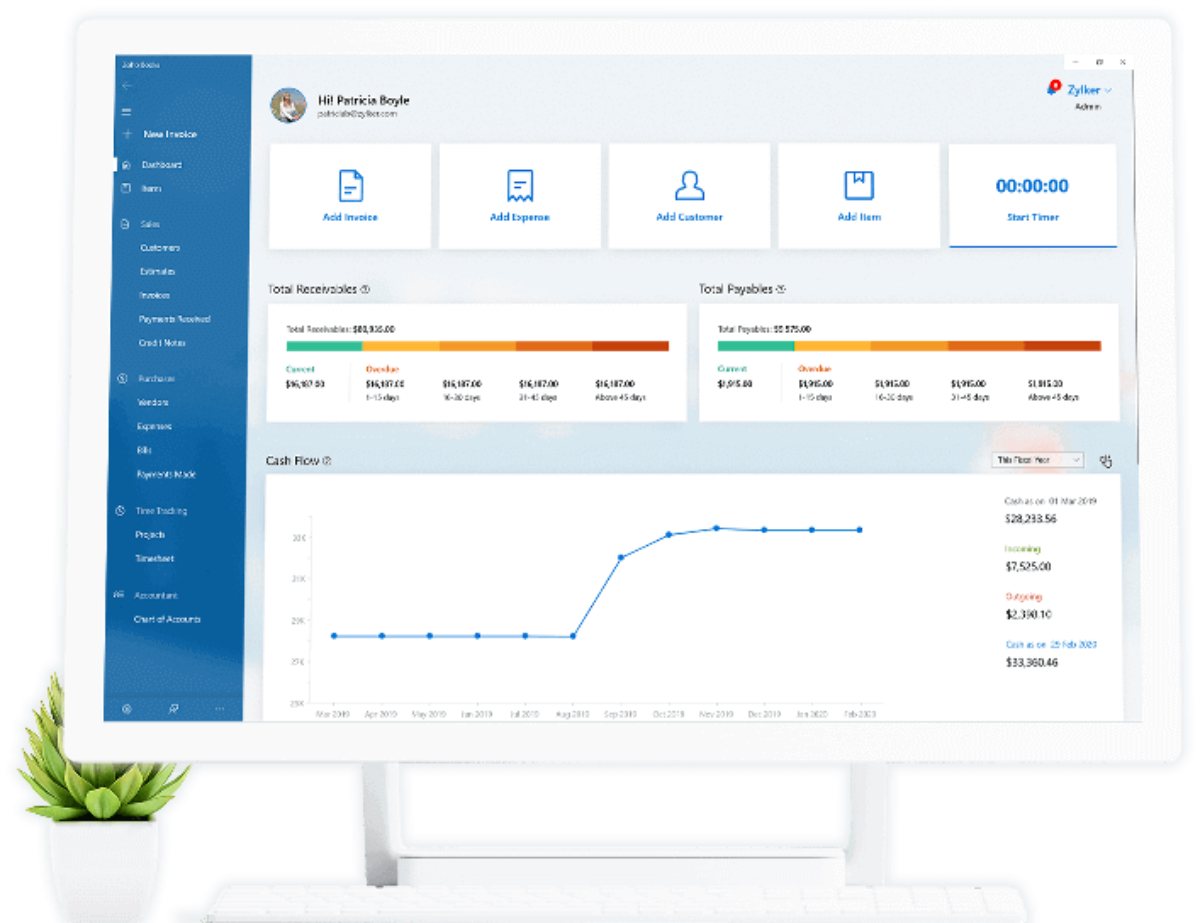

Zoho Books is a comprehensive cloud-based accounting software designed to streamline financial management for businesses of all sizes. Its user-friendly interface, coupled with an array of powerful features, makes it an excellent choice for managing finances efficiently. Zoho Books integrates seamlessly with other Zoho applications, providing a cohesive ecosystem for business operations.

Features

- Invoicing

- Expense Tracking

- Bank Reconciliation

- Inventory Management

- Project Management

- Time Tracking

- Sales Orders

- Purchase Orders

- Multi-currency Handling

- Client Portal

- Automated Workflows

- Reporting

Top 3 Features

1. Invoicing:

Zoho Books allows you to create customized, professional invoices. You can also set up recurring invoices for regular customers.

2. Bank Reconciliation:

This feature simplifies the process of matching your financial records with your bank statements, reducing errors and ensuring accuracy.

3. Expense Tracking:

Zoho Books helps you track and categorize your expenses, making it easier to manage your budget and identify areas for cost savings.

Pros

- Easy to navigate and use.

- Seamlessly integrates with other Zoho applications and third-party tools.

- Automates various accounting tasks, saving time and reducing errors.

- Suitable for businesses of all sizes, from startups to large enterprises.

- Ideal for businesses dealing with international clients.

Cons

- Some users may find customization options limited compared to other accounting tools.

- New users may need time to get accustomed to the interface and features.

- Customer support can sometimes be slow in responding to queries.

Pricing

Zoho Books offers a tiered pricing structure to accommodate different business needs:

-

Free Plan:

For businesses with annual revenue of up to $50,000, includes essential features.

-

Standard Plan:

$20 per organization per month, includes additional features like project management and multi-currency handling.

-

Professional Plan:

$50 per organization per month, includes advanced features such as purchase orders and inventory management.

-

Premium Plan:

$70 per organization per month, includes custom domain, custom roles, and advanced analytics.

-

Elite Plan:

$150 per organization per month, includes advanced inventory, warehouse management, and more.

-

Ultimate Plan:

$275 per organization per month, includes all features and priority support.

Final Verdict

Zoho Books, a Xero alternative is a robust accounting tool that offers a wide range of features to help businesses manage their finances effectively. Its seamless integration with other Zoho products makes it an excellent choice for businesses already using Zoho’s suite of applications. While it may have a learning curve for new users, its automation capabilities and user-friendly interface make it a strong contender in the accounting software market. The tiered pricing plans ensure that businesses of all sizes can find a suitable option to fit their needs and budget.

3. Xero

Xero is a cloud-based accounting software designed to simplify the financial management processes for businesses of all sizes. Known for its user-friendly interface and powerful features, Xero helps businesses manage their finances efficiently, allowing them to focus more on growth and less on paperwork.

Features

- Invoicing

- Bank Reconciliation

- Expense Management

- Inventory Management

- Payroll

- Reporting

- Multi-Currency

- Mobile Access

- Project Management

- Integrations

Top 3 Features

1. Invoicing:

Xero allows you to create and send professional invoices, track their status, and follow up on unpaid bills, ensuring you get paid faster.

2. Bank Reconciliation:

The software automates the bank reconciliation process, matching transactions with your bank statements, saving you time and reducing errors.

3. Expense Management:

Xero simplifies expense tracking by allowing you to capture receipts, categorize expenses, and monitor spending in real-time, aiding in better financial control.

Pros

- Easy-to-use interface

- Extensive integration options

- Robust reporting capabilities

- Mobile-friendly for access on the go

- Comprehensive customer support

Cons

- Higher pricing for advanced features

- Limited inventory management for larger businesses

- Occasional syncing issues with bank feeds

Pricing

Xero offers three pricing plans:

- Starter Plan: $25/month, suitable for sole traders and new businesses.

- Standard Plan: $40/month, ideal for growing businesses.

- Premium Plan: $54/month, perfect for established businesses needing multi-currency support.

Final Verdict

Xero stands out as a powerful accounting tool that combines ease of use with a wide range of features tailored to meet the needs of small to medium-sized businesses. Its ability to integrate with numerous third-party apps and offer mobile access ensures that users can manage their finances flexibly and efficiently. While it may come at a higher price point, the value provided by Xero’s robust feature set and support makes it a worthwhile investment for businesses aiming to streamline their accounting processes and enhance their financial management capabilities.

Zoho Books vs Xero vs ZarMoney – Who Wins?

ZarMoney

ZarMoney takes the lead in this comparison, offering an exceptional blend of features, flexibility, and affordability. It is designed to cater to businesses of all sizes, providing a comprehensive suite of accounting tools that simplify financial management. ZarMoney’s standout features include advanced invoicing, real-time inventory tracking, and robust reporting capabilities. Its user-friendly interface, coupled with excellent customer support, ensures that businesses can efficiently manage their finances without a steep learning curve. Moreover, ZarMoney’s competitive pricing and extensive customization options make it a top choice for businesses looking for a reliable and scalable accounting solution.

Xero

Xero is a strong contender, known for its cloud-based platform and user-friendly design. It excels in providing seamless bank reconciliation, professional invoicing, and efficient expense management. Xero’s ability to integrate with over 800 business applications makes it highly adaptable to various business needs. However, its higher pricing and occasional syncing issues with bank feeds can be a drawback for some users. Despite these minor setbacks, Xero remains a solid choice for businesses that require a robust and versatile accounting tool with extensive third-party integration options.

Zoho Books

Zoho Books is another worthy competitor, particularly appealing to small and medium-sized businesses due to its affordability and ease of use. It offers a comprehensive set of features, including automated workflows, project management, and multi-currency handling. Zoho Books also integrates seamlessly with other Zoho products, creating a cohesive ecosystem for business management. However, it may not be as feature-rich as ZarMoney or Xero, especially for larger enterprises with more complex accounting needs. Nevertheless, Zoho Books provides excellent value for money and is a great option for businesses looking for a cost-effective and efficient accounting solution.

Conclusion

When it comes to choosing the best accounting software, the decision ultimately depends on your business’s specific needs and budget. ZarMoney stands out as the top choice due to its comprehensive feature set, affordability, and exceptional customer support. It caters to businesses of all sizes and offers robust customization options, making it a versatile and reliable solution.

Xero is a strong option for those seeking extensive third-party integrations and a user-friendly interface, although it comes at a higher price point. It is particularly well-suited for businesses that need advanced features like bank reconciliation and expense management.

Zoho Books, while not as feature-rich as ZarMoney or Xero, provides excellent value for small and medium-sized businesses with its affordable pricing and seamless integration with other Zoho products.

FAQs

1. What is the best accounting software for small businesses?

ZarMoney is highly recommended for small businesses due to its affordability, comprehensive features, and excellent customer support.

2. How does Xero’s pricing compare to ZarMoney and Zoho Books?

Xero tends to be more expensive than both ZarMoney and Zoho Books, especially for advanced features and multi-currency support.

3. Can I use ZarMoney for inventory management?

Yes, ZarMoney offers real-time inventory tracking, making it suitable for businesses with inventory management needs.

4. Is Zoho Books suitable for large enterprises?

While Zoho Books is great for small to medium-sized businesses, it may lack some advanced features needed by larger enterprises.

5. Does Xero integrate with other business applications?

Yes, Xero integrates with over 800 third-party applications, offering extensive flexibility for various business needs.

6. Which software offers the best customer support?

ZarMoney is known for its exceptional customer support, providing timely and effective assistance to its users.

7. Can I access these accounting tools on mobile devices?

Yes, all three software options—ZarMoney, Xero, and Zoho Books—offer mobile apps for on-the-go access to your accounts.

8. What are the key features of ZarMoney?

ZarMoney offers advanced invoicing, real-time inventory tracking, robust reporting, and seamless integration with other tools.

9. Is it easy to switch from another accounting software to ZarMoney?

Yes, ZarMoney provides tools and support to help businesses transition smoothly from other accounting software.

10. Which software is best for multi-currency handling?

Xero is highly regarded for its multi-currency handling capabilities, making it ideal for businesses with international transactions.

Shashi Teja

Related posts

Hot Topics

Everything You Need to Know About a Savings Plan in 2025

A savings plan is a financial tool that offers the combined benefits of insurance & growth. This ensures financial security…

Mobile Threat Defense: The Silent Shield Behind Every Secure App

Mobile apps are found everywhere in India’s rapidly developing digital landscape—from banking and online shopping to healthcare and learning. And…